Recommendation

The recommendation is a subset of the stocks selected in the previous tab.

The methology is based on Modern portfolio theory.

There are different methods and parameters.

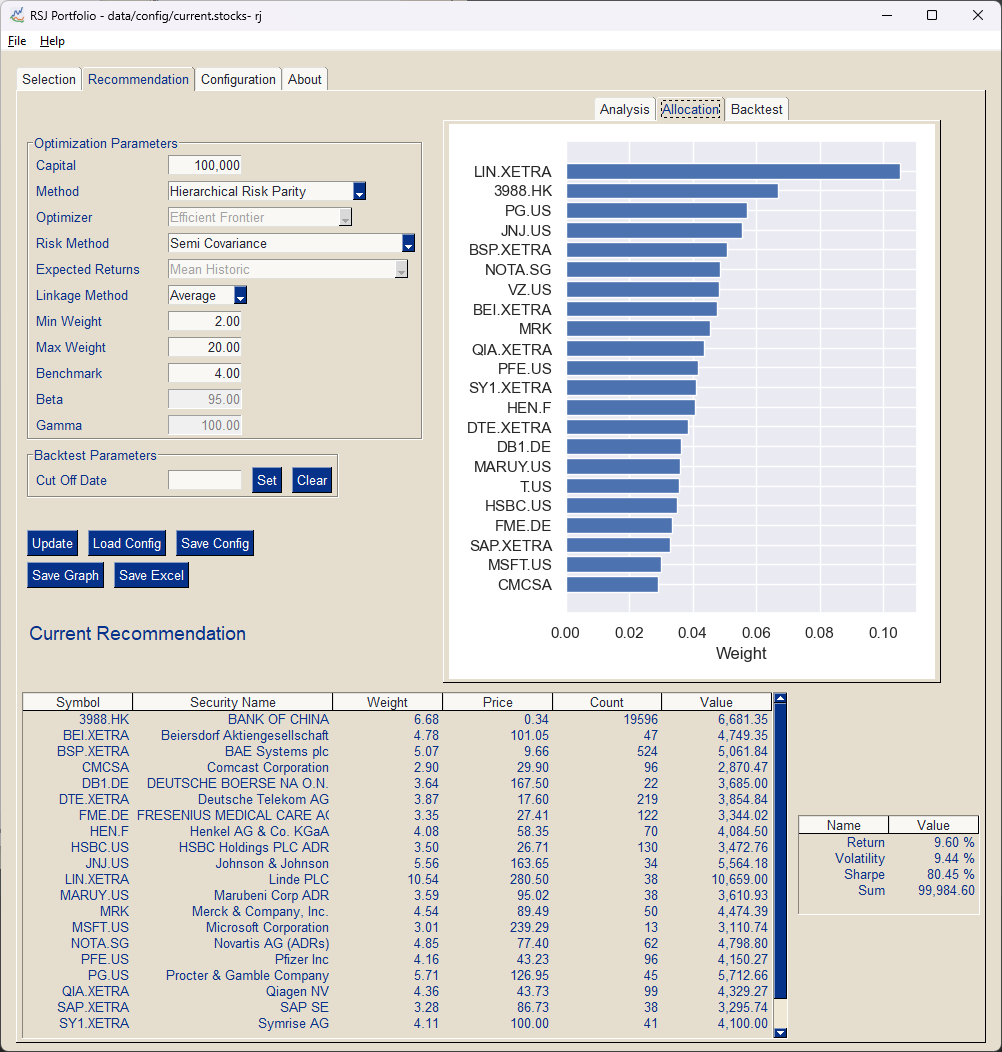

Optimization Parameters

Capital

- This restriction is only partially implemented (e.g. if an exact division of the amount into whole stocks is not possible)

Methods

- Minimum Volatility

- Maximum Sharpe Ratio (optimize ration between volatility and return)

- Minimum Semi Variance (minimize downside volatility)

- Hierarchical Risk Parity (minimize cluster portfolio based on correlation and optimize volatility between outliers and cluster)

- Conditional Value at Risk (minimize risk of portfolio at a given confidence level)

Method used for Risk Determination

- Covariance

- Semi Covariance (down side only)

- Exponential covariance

- Leodit Wolf

- Leodit Wolf Exponential

- Leodit Wolf Exponential single factor

- Leadit Wolf Constant Correlation

- Oracle Approximation

Expected Returns

- Mean Historic

- EMA Historic (use exponentially weighted moving average)

- Capital Asset Pricing Model

Minimum Weight

- Minimum weight (in percent) of selected stocks in portfolio (0.00 \<= x \<= 100.00)

- This restriction may not be fully implemented (e.g. if the value is smaller than the maximum weight)

Maximum Weight

- Maximum weight (in percent) of selected stocks in portfolio (0.00 \<= x \<= 100.00)

- This restriction may not be fully implemented (e.g. if the number of selected stocks is too small to invest 100% with this weight)

Benchmark

- Benchmark value development of zero risk investment in percent per year

Beta

- Certainty in percent, that the daily risk is below 3% (0.00 \<= x \<= 100.00).

- This parameter is only need for Conditional Value at Risk

Gamma

- L2 regularization parameter in percent. Setting this parameter over 100% increases the number of non reo weights.

Backtest

If you enter a cutoff date, the software build the portfolio based on the data available at the cutoff date and then calculates the development of that (static) portfolio from that date on until day

Note: Past performance of a strategy does not guarantee future performance.

Note: Backtests are susceptible to hindsight bias. When you do a backtest today you will inadvertedly use information that was not available at the time of the backtest (ie you will not select stocks of companies that went bankrupt within the last year). This will improve your backtest results considerably.

Results

Proposed capital distribution of the portfolio

Statistically expected results of the proposed portfolio